[San Francisco, CA, October 29th, 2024] - Restaurants need to employ a more sophisticated approach to pricing. Rather than solely relying on food costs or gut feeling to set menu pricing, today’s multi-channel restaurants need pricing that’s fluid, responsive to what your competitors are doing, and automated.

Fluid means pricing that responds to the market, preserves your market share, and can seamlessly shift as needed. Responsive means taking into account how your competitors are pricing their menu items, both in person and online. Automated means your team can stop spending time manually monitoring competitor prices, so you can put the focus back on delivering an excellent customer experience in every channel.

In this current restaurant economy where consumers are fed up with high prices and value wars reign supreme, every cent counts—for both customers and operators.

To help operators make sense of these increasingly complex dynamics, JUICER is launching a multi-part series to examine how multi-unit restaurants currently set their prices, how a competitive analysis can grow sales, and how automating the process can help brands stay ahead of their competitors with real-time digital pricing insights and recommendations on a location, regional, and national scale.

A Deep Dive in Menu Pricing

The restaurant industry has come so far in recent years by bringing advanced data collection, automation and artificial intelligence into the business. As many brands have discovered, however, customer and transaction insights are only valuable if you have the resources to effectively employ them.

Untangling this mess will be the next mega-trend moving the restaurant industry forward. Rather than giving operators yet another data stream to monitor and interpret, a modern approach to pricing takes this work off your operations team’s plate, while ensuring that your menu is priced perfectly for the moment, whether it’s Mother’s Day, Super Bowl Sunday or any given Monday.

In this series on data-driven pricing, we’re going to hear from multi-unit operators on how they set prices and how that’s changed in recent years. We’re also going to examine macro- and microeconomic trends influencing pricing after years of historic inflation and rising input costs. Most importantly, we’re going to show how brands large and small can begin using real-time data to ensure your menu pricing attracts new customers, boost frequency from existing customers, and save your team a significant amount of time.

A Domino’s Snapshot

In this moment of elevated price sensitivity, many national restaurants are offering increasingly competitive deals to their guests. Without a significant change in the near-term macroeconomic environment, this dynamic is likely to persist beyond the end of the year.

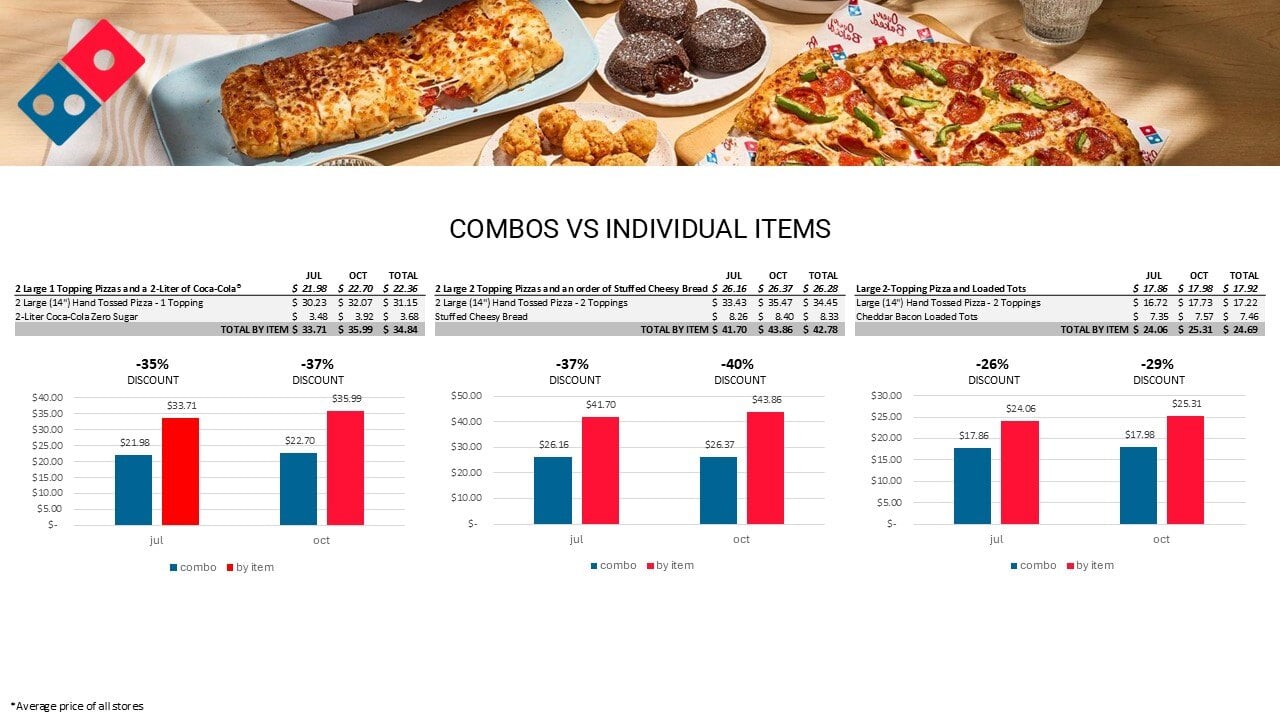

Combos vs Individual Items: Three recent combo deals from Domino’s show how some national brands are discounting items to drive traffic and lower the total cost for price-conscious customers.

As one of the most closely watched value brands, Domino’s is an instructive barometer to examine the price of combo deals against the cost of individual items in the combo if purchased separately. To capture a snapshot of this hypothesis that deals are gaining steam, JUICER’s development team compared limited-time combo offers from Domino’s that showed discounting rates increasing to 29, 37, and 40 percent in October.

One such Domino’s deal, a large two-topping pizza with Loaded Tots, is priced at a 29 percent discount this month—a total transaction of $17.98 compared to $25.31 if ordered individually. The discount rate for this combo increased from 26 to 29 percent from July to October.

Next up, a deal for two large one-topping pizzas with a two-liter of Coca-Cola, was priced at $21.98 in July and $22.70 in October, with the discount rate increasing from 35 to 37 percent during the three-month period. Increasing that discount rate equates to a significant price-point shift for the consumer, with that combo now priced at $22.70 versus $35.99 if the items were ordered individually.

For our final deal snapshot, two large two-topping pizzas with an order of Stuffed Cheesy Bread highlighted a significant delta for the combo compared to ordering individually. In July, that combo was priced at $26.16 versus $41.70 for a discount of 37 percent. This combo increased in price to $26.37 in October, now a 40-percent discount, with those menu items ringing up at $43.86 when ordered individually. Again, this is a significant discount on the consumer’s side of the deal.

Looking Ahead to 2025

The Consumer Price Index (CPI) has dropped to its lowest rate since February of 2021. The U.S. unemployment rate is hovering just above 4 percent, which is considered full employment on a national basis. In addition, same-store traffic at quick-service restaurants declined by low single digits throughout the summer, with a slight uptick in September.

With restaurant inflation cooling in recent months but still historically elevated, we’re likely to see a continuation of discounting wars, especially among closely watched national brands. In fact, Paul Tudor Jones, a reputable commodities trader, said in this recent CNBC interview that we are likely to see a resurgence of inflation. Moreover, as labor costs remain persistently high, this competitive pricing environment will continue pressuring operators to think strategically about any upcoming deals or pricing adjustments.

As more consumers order through digital channels that make on-the-spot price comparisons clearer than ever, pricing will remain the most carefully scrutinized part of the business moving into 2025—and a primary opportunity for restaurants to increase revenue amid stagnant traffic levels.

Please follow along with our upcoming installments of this series as we dive deeper into pricing strategies, strategy shifts, and ways to ensure your restaurant is using pricing to grow your business, rather than turning potential customers away.